WHY APARTMENTS

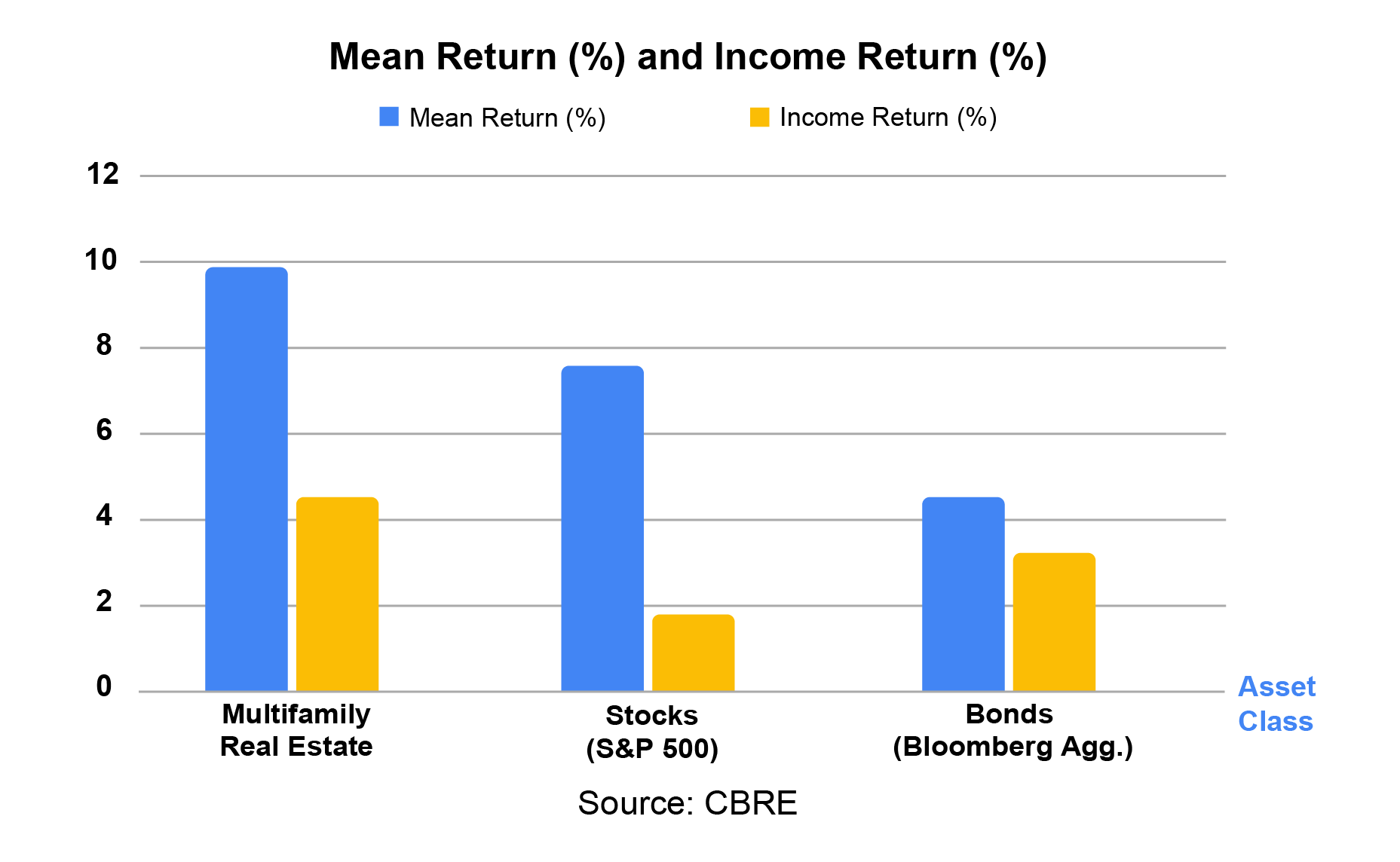

Apartments outperform stocks and bonds

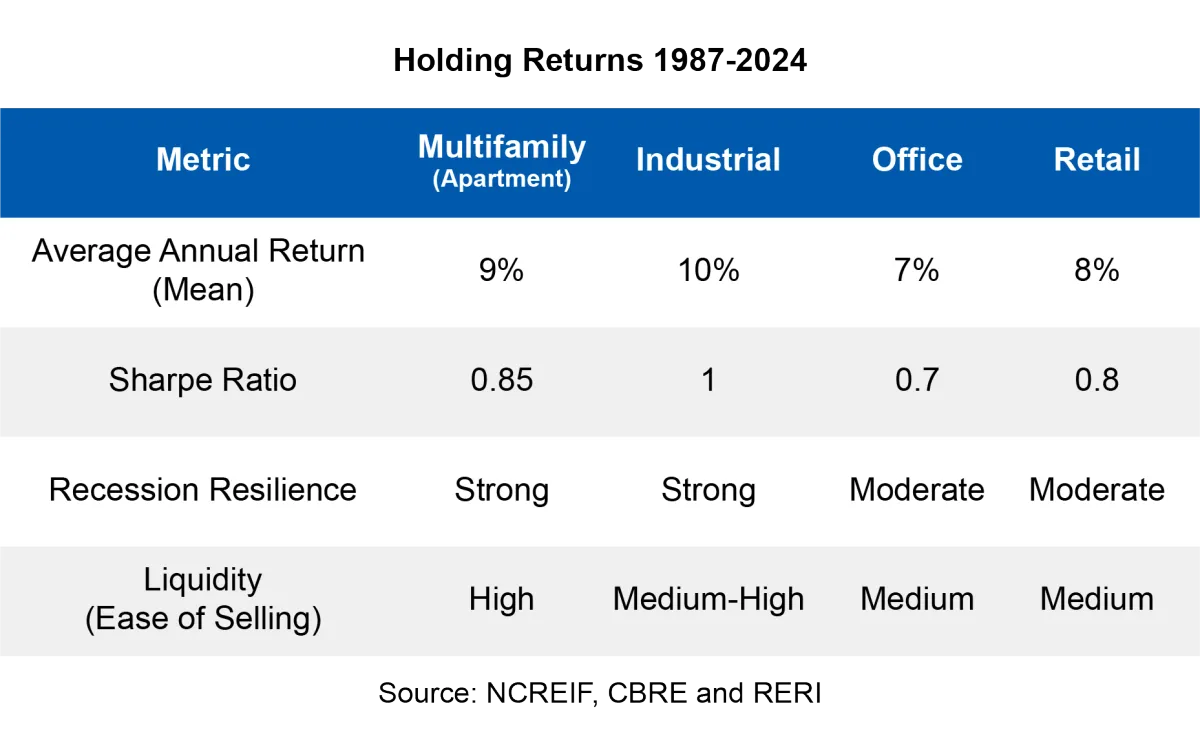

Investing in multifamily properties has consistently outperformed other real estate asset classes, delivering strong income returns and equity growth. According to NCREIF data, multifamily properties have historically provided an average annual return of 9.05% and a stable income return of 4.23%, surpassing office, retail, and industrial sectors.

Multifamily investments outperform other real estate classes

This combination of steady cash flow and long-term appreciation makes multifamily a top choice for investors looking to maximize returns while minimizing risk. With a Sharpe Ratio of 1.21, multifamily real estate offers superior risk-adjusted performance compared to stocks and other commercial real estate investments.

For investors, this means the potential for consistent monthly income alongside wealth accumulation over time, making apartments an ideal asset for both passive income seekers and long-term portfolio growth.

Apartments outperform stocks and bonds

Investing in multifamily properties has consistently outperformed other real estate asset classes, delivering strong income returns and equity growth. According to NCREIF data, multifamily properties have historically provided an average annual return of 9.05% and a stable income return of 4.23%, surpassing office, retail, and industrial sectors.

A Low-Risk, High-Reward Investment Option

This combination of steady cash flow and long-term appreciation makes multifamily a top choice for investors looking to maximize returns while minimizing risk. With a Sharpe Ratio of 1.21, multifamily real estate offers superior risk-adjusted performance compared to stocks and other commercial real estate investments.

For investors, this means the potential for consistent monthly income alongside wealth accumulation over time, making apartments an ideal asset for both passive income seekers and long-term portfolio growth.

Take Advantage Of Increased Tax Benefits

Our Team only acquires stabilized (above 80% occupancy) and cash flow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of 3 types of depreciation that allow investors to lower taxes:

1

Standard or Straight-line Depreciation

2

Accelerated Depreciation

3

Bonus Depreciation

Cost segregation studies are performed on all of our assets and the tax benefits pass through to our investors via annual year end reporting on K1s that are issued for the preceding year.

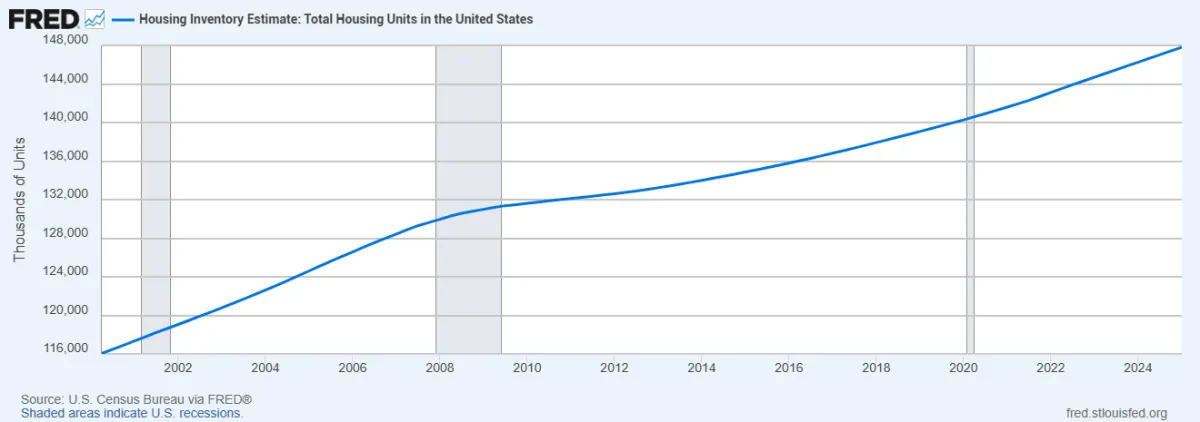

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s, home ownership has been significantly dropping, and it will continue to drop as millennials, and aging baby boomers want to stay mobile in the 21st century.

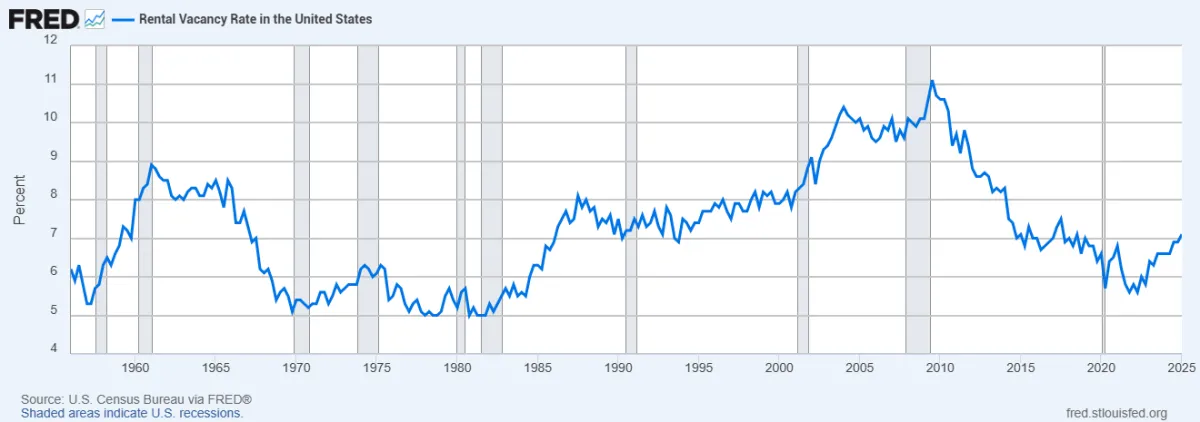

Vacancy rates remain low due to increased demand

With the population continuing to increase, demand for apartments is at an all-time high. This increase drives the need for apartment living higher and higher. Low vacancy rates equal more significant cashflow and equity growth, which translates to higher returns for our investors.

Investors Love Working With Us

Our investors choose DGV because we put their goals first and make the process simple, transparent, and impactful. We provide access to exclusive multifamily opportunities in high-growth markets—investments designed to create lasting wealth and stronger communities. Let’s talk about how we can help you achieve financial freedom through passive real estate investing.

Investors Love Working With Us

Our investors choose DGV because we put their goals first and make the process simple, transparent, and impactful. We provide access to exclusive multifamily opportunities in high-growth markets—investments designed to create lasting wealth and stronger communities. Let’s talk about how we can help you achieve financial freedom through passive real estate investing.

©2026 Dynasty Growth Ventures.

All Rights Reserved.

No Offer of Securities—Disclosure of Interests

Under no circumstances should any material at this site be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments.